Join other trail-blazing young adults in getting monthly career & financial tips, written by those who have succeeded before.

#3: Which budgeting method works best for me? | FRANK BY OCBC

Want to upgrade to the new iPhone next year? Or buy that new pair of Nike’s 3 months from now? Or pay off your student loans before you hit your 30s? Or even simply building your emergency fund of at least 3 to 6 months’ worth of expenses?

Believe it or not, a budget is the best tool to help you make those purchases without putting yourself in unnecessary stress or debt.

A budget is simply a plan that outlines how you’re going to spend your income each month. The whole point of budgeting is so you allocate your money purposefully to meet your goals. When you have a clear picture of where your money is coming and going, you are in control of your money, rather than letting money control you.

The next question then is: which budgeting method should I use? And there’s no “one size fits all” answer to that. Seeing as we all have different financial situations, goals, and lifestyles, those things can affect the type of budgeting method that will work best for you.

We run through three common budgeting methods and determine which method would work best for you now:

1. The 50/30/20 rule

With this budgeting method, you’ll allocate 50% of your income to your needs, 30% of your income to your wants, and 20% of your income to your savings.

For example, if you earn $3,000 a month, here’s how your budget would look like based on the 50/30/20 rule:

50% needs - $1,500

30% wants - $900

20% savings - $600

Who is this method suited for?

Ideal for beginners and those who prefer simplicity.

Pros

This method is easy to set up. Not only that, the 50/30/20 rule helps you define and prioritise your essential expenses. Plus, you don’t have to track your expenses meticulously.

To help you stick to this rule, you can set up automatic deductions for your monthly bills, and recurring deposits to your savings.

Cons

The 50/30/20 rule may not be realistic for those with significant debt or low income. For example, your student loans could take up 70% of your income if you’re working part-time.

However, you can customise the rule by using different percentages to better suit your financial situation.

For instance, you can change the percentages to 70/10/20 if you have a lot of essential expenses to take care of. In addition, if you’d rather be more aggressive with your savings, you could change the percentages to 50/20/30, allocating less money to your needs and more towards your savings.

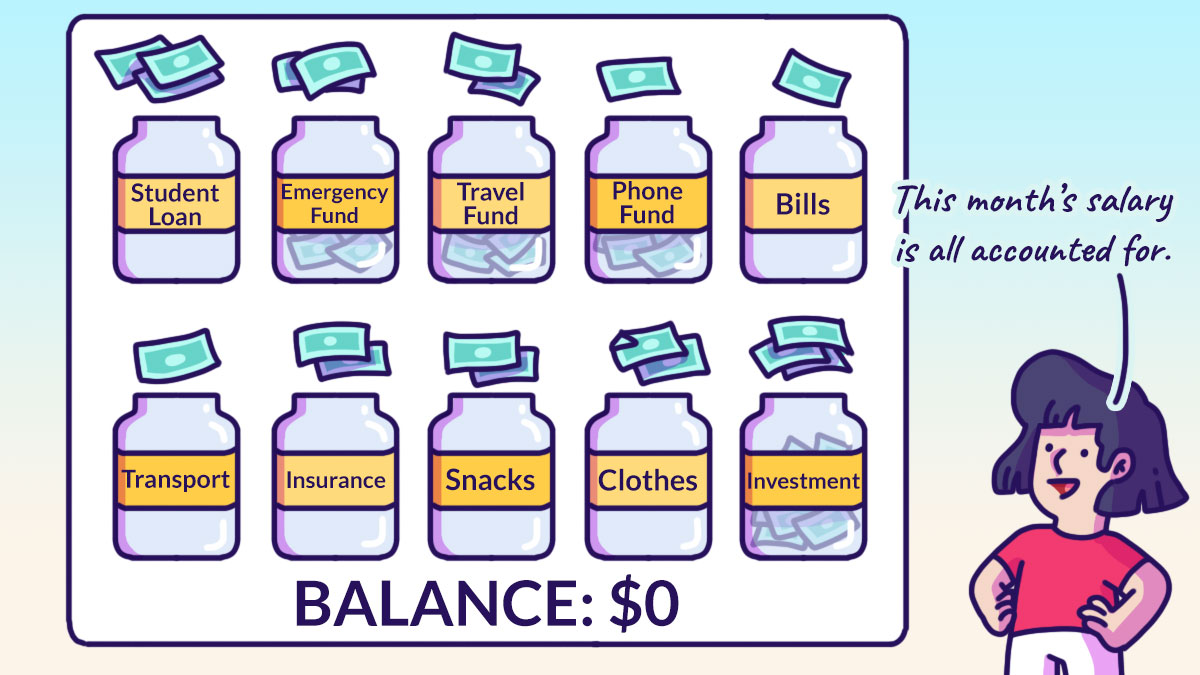

2. Zero-based budgeting

In a zero-based budget, every dollar has its purpose. Your goal is to allocate each dollar you earn to a specific purpose, whether its expenses or savings, until the balance is zero.

Let’s say you earn $3,000 a month. At the start of the month, you’ll sit down and categorise your expenses and allocate your income accordingly to importance. It could look something like this:

Income = $3,000

| Student loan | $400 |

| Emergency fund | $300 |

| Travel fund | $250 |

| Phone fund | $150 |

| Bills | $100 |

| Transport | $200 |

| Insurance | $150 |

| Eating out | $450 |

| Clothes | $500 |

| Snacks | $100 |

| Income tax | $100 |

| Entertainment | $200 |

| Investment | $100 |

Amount left = $0

Who is this method suited for?

This method is great if you love tracking expenses and knowing where every cent goes. It’s also suited for those who can predict the monthly income that they’ll receive.

Pros

A zero-based budget gives you a detailed snapshot of how you’re spending your money so you can make tweaks and adjustments to meet certain goals as you go along in your financial journey.

You may suddenly decide that you don’t want to upgrade your phone after all, and then you can allocate the funds you were setting aside for it every month to other expense categories.

Cons

Success of this method means needing to track and monitor your expenses closely, hence it will take up more of your time compared to the other methods. And if you have an irregular income, the zero-based budget might not work as well because it’s hard to predict how much you’ll earn and therefore can set aside for each spending category.

3. Pay yourself first

With the pay-yourself-first method, you prioritise savings first – in essence, you’re paying for your future self. Then, the remaining is used to pay for your monthly expenses and general spending.

Start by setting a monthly savings target. This could be 30% of your income or your allowance. For someone earning $3,000, that means setting aside $900 into a dedicated savings account for your savings. The remaining $2,100 can then be used for things like food, transport, phone bills, movies and nights out with friends.

And if you’re working with a $400 allowance, it means putting $120 away in the bank and trying to keep your expenses to just $260.

Who is this method suited for?

This method is suitable for those who want to prioritise savings simply and easily. For those who have irregular income, this method ensures that you’re saving money no matter what your income looks like each month.

If you’re a student, this method is a good way to discipline yourself to save monthly. It works too if you’re freelancing or doing part-time work – put aside a portion of the money to go into your savings, whilst the rest can be used freely, whether it’s to pay for a new gadget or to treat yourself to a good meal.

Pros

Paying yourself first instils a savings-focused mentality, ensuring you allocate funds to your future self and essential needs first. Once that’s done, the balance can be used for guilt-free spending. It’s also a great way to develop the habit of saving and spending within your means.

Cons

Unexpected expenses may result in you dipping into your savings so this method might not be suitable for those who have yet to set up an emergency fund. Additionally, this method might fail if you use a credit card as you can lose track of whether you’re spending within your means if you’re not keeping a watchful eye on how you use your credit card.

Finding the right fit

Choosing the right budgeting method is a bit like picking the ideal playlist for your financial journey – everyone has their own preferences because of the goals they’ll want to achieve.

If you’re someone who thrives when there’s a plan, zero-based budgeting is likely to work well with you as it plans where your money is going right down to the dollar. If you’re someone who prefers to go with the flow but yet is disciplined enough to watch your spending, paying yourself first will help ensure that you do have money for a rainy day.

Or if you’re still working out what your money management style is like, the 50/30/20 rule is a good place to start as it provides structure, whilst giving you wiggle room to make on the fly changes with where your money is going. So take a look at your money situation, goals, and what vibes with you to find the method that fits you best.

Once you’ve found a method that you like, then it's about putting it into action as soon as possible so you’re on your way to better finances. And it’s alright if you don’t immediately pick the “right one” – if it doesn’t work, try another method that might work better. It’s better than not trying one at all, because the best budget is the one that’s in action.

Content sponsored by FRANK by OCBC

No matter what budgeting method you decide on, the OCBC Digital app has the right tools to make your money last longer!

Ready to tackle zero-based budgeting? Track all your cash flows and sort your spending categories – all in the OCBC Digital app! Learn more about Money In$ights here.

Planning to pay yourself first? Set a Savings Goal on the OCBC Digital app and watch your money automatically go towards your goal with no separate account needed. Learn more here.

Not a FRANK member yet?

Get your hands on the limited edition FRANK Debit Card featuring The Simple Sum characters: Sam the sotong, Ah Long the shark and Ollie the otter.

Follow @frankbyocbc and @thesimplesum on Instagram to stay tuned to the FRANK x The Simple Sum Money Series!

Terms of Use

Any opinions or views of third parties expressed in this article are those of the third parties identified, and not those of OCBC Group. No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided in this article is given by OCBC Bank and it should not be relied upon as such. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided in this article.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

1Basic Financial Planning Guide 2023 by The Monetary Authority of Singapore