Executives

Let your money do

its thing

Fresh graduate, or identify as quite fresh? OCBC 360 Account and FRANK Credit Card will help you grow your money while doing what you do best.

Basics first

Start with the easy wins

OCBC 360 Account

Up to 1.55% a year for just crediting your salary

Combine that with saving S$500 every month and a balance of S$15,000, and you can get up to S$252.00 a year. That's a free subscription of your favourite streaming service to reward yourself.

Why consider this

-

Low

min. monthly salary

Only S$1,800. Start earning from 1.25% a year when you credit your salary.

-

Up to 1.55%

a year

for salary credit

Your bonus interest grows when your balance grows over S$100,000

-

Upgrade to

2.05%

a year

Earn more if you also save S$500 every month

FRANK Credit Card

Score up to 10% in cashback

The FRANK Credit Card just got even better! Earn more when you spend across categories. Get up to S$100 back each month with your favourite way of shopping.

Why consider this

-

8%

cashback on SGD and FX transactions

Includes foreign currency transactions and online/contactless mobile transactions in SGD

-

2%

bonus cashback at selected green merchants

Transactions made at SimplyGo, BlueSG, Scoop Wholefoods and more

-

Min.

S$800

monthly spend

Online or offline, hit this total and get up to S$100 back a month

Why consider this

-

8%

cashback on SGD and FX transactions

Includes foreign currency transactions and online/contactless mobile transactions in SGD

-

2%

bonus cashback at selected green merchants

Transactions made at SimplyGo, BlueSG, Scoop Wholefoods and more

-

Min.

S$800

monthly spend

Online or offline, hit this total and get up to S$100 back a month

Getting there

Stay woke, not broke with digital banking

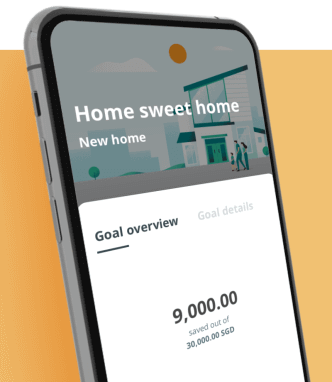

Savings goals

Stay on top of your wish list

Home renovation or safari trip? This app feature helps you set aside monthly savings and track your progress, so you're closer to your goal.

Home renovation or safari trip? This app feature helps you set aside monthly savings and track your progress, so you're closer to your goal.

Money In$ights & Budgeting

Declutter your life and receipts

Track the ins and outs of your money with insights from your mobile app. Where your money went is no longer a mystery.

Track the ins and outs of your money with insights from your mobile app. Where your money went is no longer a mystery.

Like a pro

Invest without the complications

- Start with only S$100

- Preferential rates and fees

- Low commission rates

Blog

If you need more convincing

Here are some reads you may find helpful that we totally approve of.

-

Terms and conditions

- Terms and Conditions Governing the OCBC 360 Account

- Terms and Conditions Governing Deposit Account

- Terms and Conditions Governing Electronic Banking Services

- Terms and Conditions Governing OCBC Electronic Statements

- Terms and Conditions Governing Automatic Standing Instruction

- Terms and Conditions Governing FRANK Credit Card Cashback Programme

-

Important notices

- Fees & Charges

- GIRO

- Insured Deposits Register

- Important Notice for Insurance

- Structured Deposits Disclaimer

- Important Notice for Investments

- Unit Trust Disclaimer

- OCBC Credit Cardmembers Agreement

- All about the FRANK Cash Rebates Reward Programme

- All about NETS FlashPay and how it works

- Removal of NETS FlashPay feature on FRANK Credit Cards

- Fees & Charges for Credit Cards

- FAQ - Removal of NETS FlashPay on FRANK Cards

-

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

-

Policy Owners' Protection Scheme

This plan is protected under the Policy Owner's Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).