Students

Your 1st account & card. Own it.

Perk up your student journey with the FRANK Account and Debit Card – save for that overseas exchange and enjoy sweet deals all year round.

Pit stop #1

Save, spend, repeat

FRANK Account

You don't even have to do much

We like being extra with our rates. Earn up to 0.2% a year when you save with a FRANK Account. Chill out and watch your money grow.

Why you'll love this

-

S$0initial deposit

Open the account with no initial deposit

-

S$0fall below fees

For youths below 26 years old

-

4xhigher interest

As compared to regular savings accounts

FRANK Debit Card

Form meets function

Enjoy 1% cashback when you spend on things you love. Even better, receive and use your digital card instantly when you apply via MyInfo.

Why you'll love this

-

S$0

Annual fees

Only pay for the things you buy and nothing else

-

60+

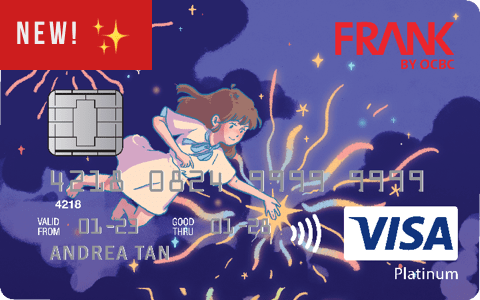

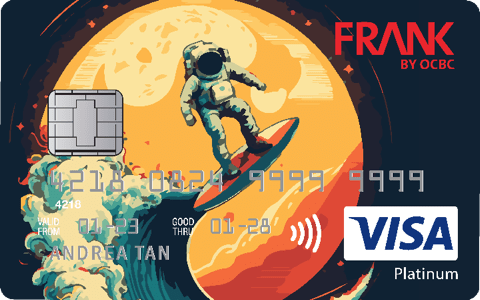

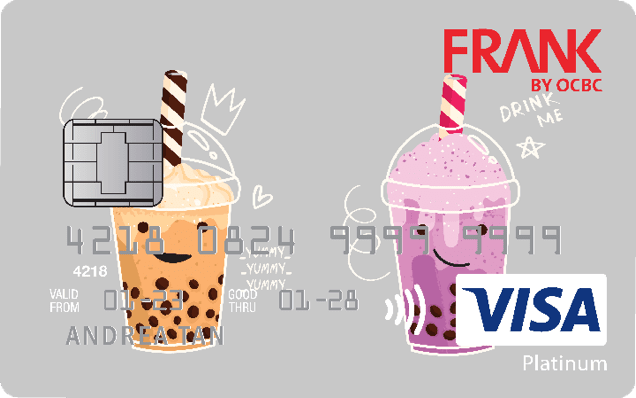

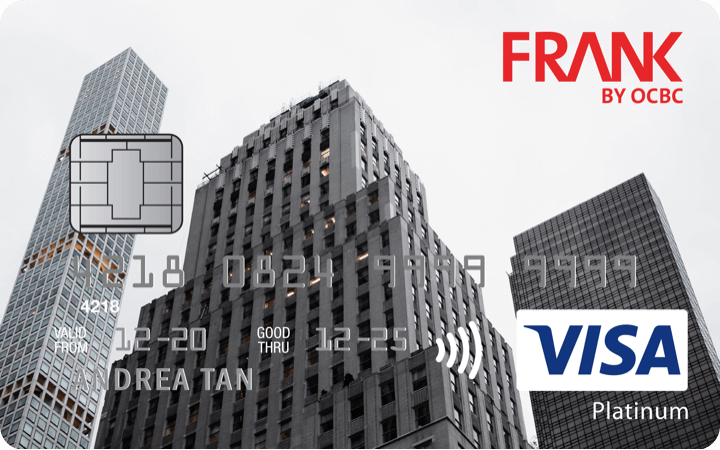

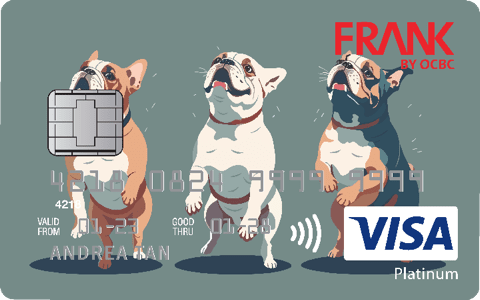

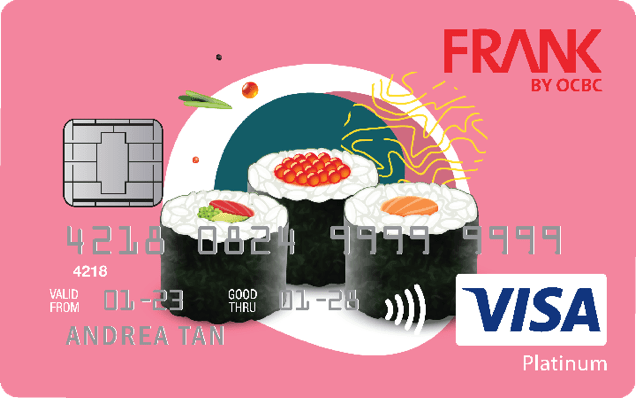

card designs

Choose a style you vibe with in our collection

-

1%

cashback

Save when you shop at Taobao, Lazada and more

Hooking you up

See all dealsWhy you'll love this

-

S$0

Annual fees

Only pay for the things you buy and nothing else

-

60+

card designs

Choose a style you vibe with in our collection

-

1%

cashback

Save when you shop at Taobao, Lazada and more

-

Terms and conditions

-

Important notices

- Automatic Standing Instruction

- Online Banking

- Insured Deposits Register

- Fees & Charges

- Deposit Insurance Scheme

- FAQ - Removal of NETS FlashPay on FRANK Cards

- Removal of NETS FlashPay feature on FRANK Debit Cards

With effect from 18 June 2016, the Debit Cardmembers' Agreement will be revised to address, among other matters, amendments and provisions relating to the introduction of digital payment services and malware risks. Please click here for the revised Debit Cardmembers' Agreement.

-

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

-

Policy Owners' Protection Scheme

This plan is protected under the Policy Owner's Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).