KICKSTART YOUR INVESTMENT JOURNEY

Affordable, flexible investing from S$100 a month. Gain access to blue chip stocks and ETFs.

- Invest in blue chip stocks and ETFs

- Benefit from dollar-cost-averaging

- Enjoy flexibility with no lock-in period

Only 0.88% for FRANK

preferential fees

Access blue chip shares from S$100

Start small and stay invested. Purchase shares in amounts below the standard lot size with your chosen monthly investment amount.

Forget about timing the market

Reduce risk and lower your investment cost price over time (through dollar-cost averaging) by investing in your selected counters each month through BCIP.

Find out how dollar-cost averaging works.

Flexibility on your investments

No lock-in period, ever. Change your monthly amount, counter selection and sell units easily through OCBC Mobile Banking app or Online Banking. You do you!

How it works

How to get started with bcip

Step 1

Choose your investment

Select a BCIP counter and your monthly investment amount.

Step 2

Apply for BCIP

Apply directly via OCBC Mobile Banking app or Online Banking with your OCBC deposit or SRS account.

Step 3

Build your portfolio

Step 4

Review your portfolio

Sit back and let your plan work its magic! Review anytime via the OCBC Mobile Banking app or Online Banking.

Counters

All about bcip counters

Understanding counters

-

What are blue chips?

Blue chips are known as common stocks of nationally known companies, with a long record of profit growth and dividend payment. Such companies typically have a reputation for quality management, products and services.

-

What are Exchange Traded Funds (ETFs)?

An ETF tracks an index, a commodity, bonds, or a basket of assets like an index fund. An ETF trades like a company shares on a stock exchange. ETFs experience price changes throughout the day as they are bought and sold.

-

How are ETFs different from Stocks?

Unlike a stock which focuses on the performance of one company, an ETF tracks an index, a commodity, bonds, or a basket of securities. This allows investors to diversify their portfolio by buying into one ETF.

-

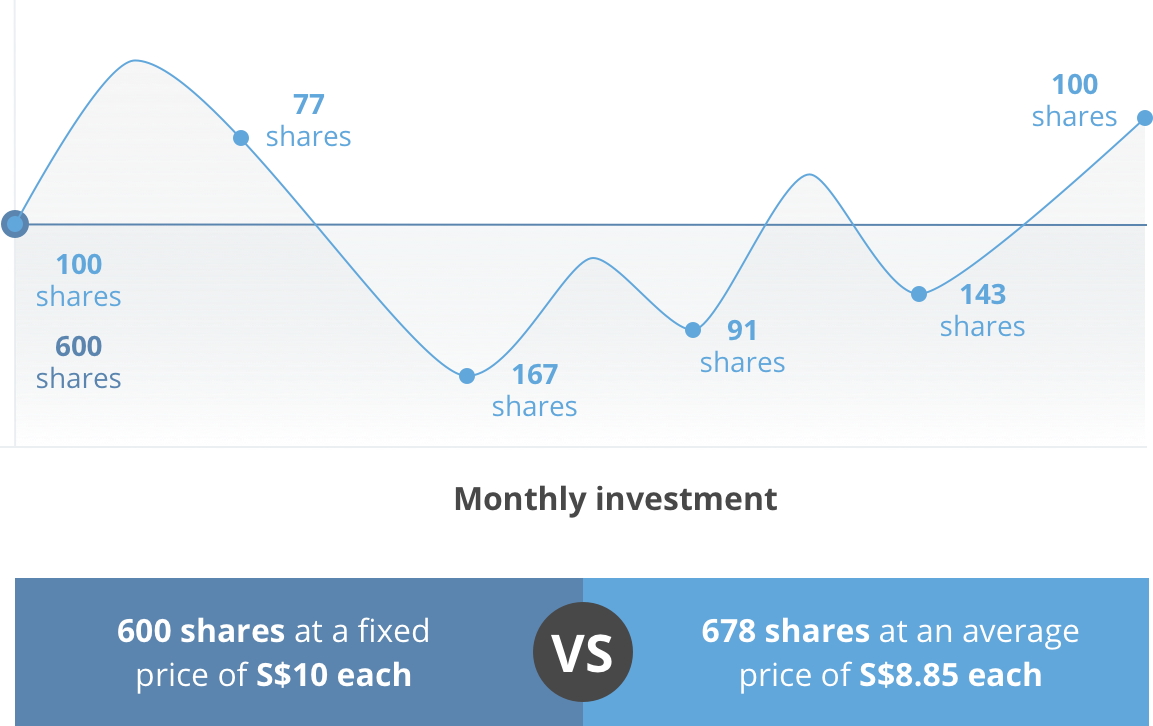

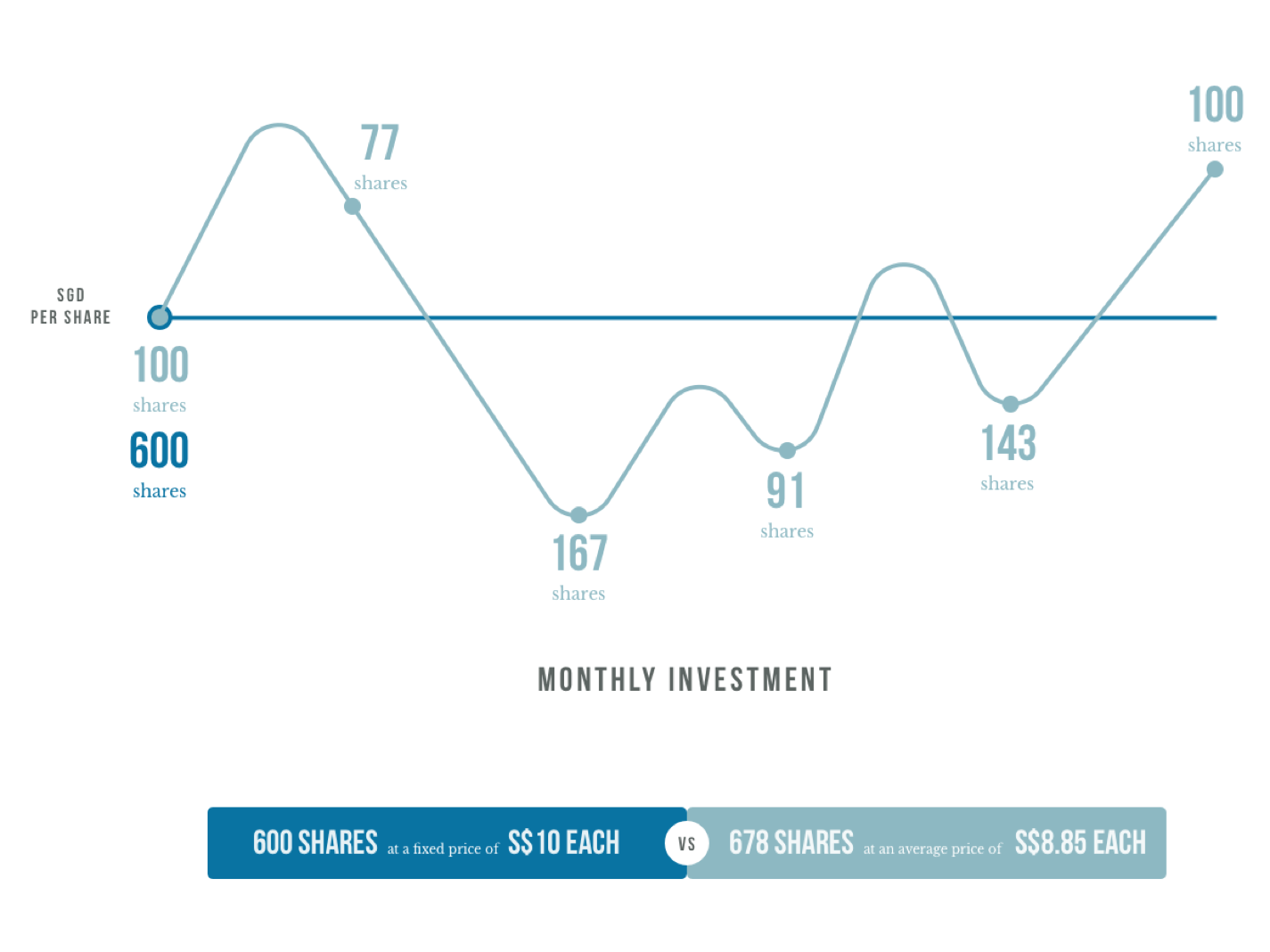

What is Dollar Cost Averaging (DCA)?

Dollar cost averaging is an investment strategy with the goal of reducing the impact of volatility on large purchases of financial assets such as stocks. DCA is done by investing equal amounts at regular intervals to purchase more units when price is low and less units when price is high. This will help to potentially lower the cost of investment over a period.

Illustration of DCA over time

-

Where can I find more details on BCIP counters?

For more description of the available BCIP counters, please refer here.

-

How do I choose which BCIP counters to invest in?

Selection of counters should be based on your own discretion as we do not provide financial advice on which counters to invest in. You may base your selection on your investment objectives and needs. Below are some objectives you may consider:

- To invest for Income, you may choose to focus on the dividends paid out by the company.

- To Invest for Capital appreciation, you may look at companies which have exhibited higher than average growth over the years and focus on how the company has grown in terms of their total return.

- For portfolio diversification, you may look at ETFs with different asset classes or companies from different sectors.

For more information on the price, performance, dividend and financial information of the companies and ETFs offered on BCIP, please refer to the official website of the respective counters.

-

What is the expected return and risk if I invest in BCIP?

In general, all investments in shares and ETFs have certain degree of inherent risk. The return and risk of your BCIP investment depend on the BCIP counters that you chose to invest in. For more information on the price, performance, dividend and financial information of the companies and ETFs offered on BCIP, please refer to the official website of the respective counters.

Understanding dividends

-

Am I eligible for dividends for my BCIP investment?

Dividends are paid out by the companies or ETFs that you have invested in via BCIP. If you hold a unit of the companies' shares or ETFs before the ex-dividend date, you will be entitled to the dividends given by the companies or ETFs.

-

How much dividends will I receive from BCIP investment?

Dividends are paid out by the companies or ETFs that you have invested in via BCIP. The exact dividend amount will be determined by the companies or ETFs that you invest in. For more information on the historical dividends of the companies and ETFs offered on BCIP, please refer to the official website of the respective counters.

-

How often will I get dividend from my BCIP investment?

Dividends are paid out by the companies or ETFs that you have invested in via BCIP. The frequency of distribution will be determined by the companies or ETFs that you invest in. For more information on the historical dividends of the companies and ETFs offered on BCIP, please refer to the official website of the respective counters.

-

Can I choose to reinvest my dividend from my BCIP investment?

There are three types of dividends - cash, shares and choice dividend. For cash dividend, the amount will be credited into your debiting account. For shares dividend, the number of shares given will be allocated to your BCIP account. For choice dividend, you will be informed to make a choice on whether to receive your dividend in cash or to reinvest as shares.

Bcip Counters

List of counters you can select from

Choose from among 21 top funds, with 14 share counters of the Straits Times index (STI) and 7 Exchange Traded Funds (ETFs) available.

TOP PICK 🏅

Oversea-Chinese Banking Corporation Limited

Sector

Banking & Investment Services

SGX Code

O39

New bcip customers

only 0.88% with FRANK Preferential Fees

Kick-start your investment with FRANK's preferential fees starting from S$0.88 per transaction (based on an investment amount of S$100), up to S$500 per counter

Before you apply

-

Eligibility

Min. age

18 years old for single account holders

Above 18 years old for parent or legal guardian and below 18 years old for child and joint account holdersNationality

Singaporean, Singapore PR or foreigner residing in Singapore (not applicable to U.S. Persons, e.g. citizen of U.S. or Green Card holder, EU resident, U.K resident or person residing within the EEA)

-

Ways to pay

OCBC account

Cash

OCBC SRS account

-

FEES & CHARGES

For new customers who are below 30 years old, with initial investment of up to S$500 per counter

-

Buying

Flat rate of 0.88% of the total investment amount

-

Selling

Flat rate of 0.88% of the total sales proceeds

-

Additional processing fee for SRS

S$0.35 (CDP Fee) + GST per counter

-

Applicable for new BCIP investment accounts opened from 28 June 2019 only.

For all other customers

-

Start in blue chips with only S$100

FAQ

See all FAQ-

What do I need to start a BCIP account?

Mode of investment OCBC deposit account OCBC Online Banking OCBC SRS account Cash SRS (only applicable for Single Account) If you do not have an OCBC SRS investment account, you may open one online through OCBC Online Banking.

If you do not have an OCBC deposit account or OCBC Online Banking, the BCIP application form allows you to apply for the two accounts at the same time. Download the application form on www.ocbc.com/bluechip, complete and mail it in.

-

How long does it take for my BCIP account to be opened? How do I know if it is successful?

You will receive an SMS on whether your BCIP account has been successfully opened seven business days after we receive your BCIP application form. This notification will be sent to the contact number as per your mobile phone records with the Bank.

If your account opening is unsuccessful, we will notify you through SMS.

-

Can I use a joint account as my settlement account?

Yes, you can choose a joint OCBC deposit account for debiting and crediting in relation to your BCIP account. However, any joint account that requires two or more signatures is not allowed for use as a settlement account.

-

If I apply today, when does my plan start? Is there a cut-off time for submission?

Action Example Your BCIP application is received between the 1st day and 12pm on the last business day of the month. We received your BCIP application on 10 July 2020. Your order will be executed on the 22nd of August 2020 (or, in the event we are unable to do so in August 2020, on the 22nd of September 2020). Your BCIP application is received after 12pm on the last business day of the month (application will be treated as having been received by us on the first business day of the next month). We received your BCIP application at 3pm on 31 July 2020. Your application will be deemed to have been received by us on 1 August 2020.

Your order will be executed on the 22nd of September 2020 (or, in the event we are unable to do so in September, on the 22nd of October 2020).

Blog

-

Terms and conditions

-

Important notices